Hello Everyone,

Here is a link to the July Newsletter.

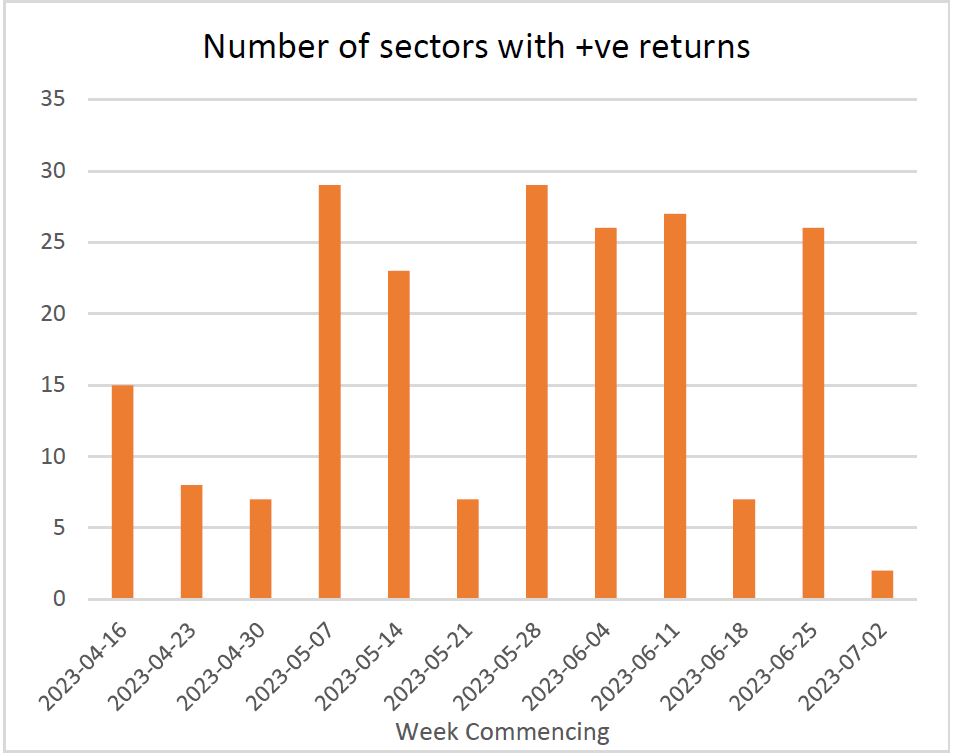

In June we saw an overall improvement in sector performance, compared with May, but it looks as though it may have been relatively short lived. Things soon took a turn for the worse.

In the first week of July, we experienced one of the most difficult weeks that we’ve seen for a long time. As I explained in last Wednesday’s weekly portfolio update, only two sectors had gone up in the previous week … Standard Money Markets and Short Term Money Markets. Most other sectors had experienced significant losses.

At the moment it looks as though last week was a little better, but we haven’t the time to analyse the data yet … I’ll update you next week when we’ve had a chance to crunch the latest numbers.

The good news is that both portfolios have made reasonable gains since Wednesday.

The main thing that I’ve noticed over the last few months is just how volatile things have been. There are many sectors that go up one month, and down the next month, without making an overall gain.

Until this situation improves there’s very little incentive to take on any additional risk.

As always, I hope that you enjoy this month’s newsletter and I look forward to hearing any feedback.

In June we saw an overall improvement in sector performance, compared with May, but it looks as though it may have been relatively short lived. Things soon took a turn for the worse.

In the first week of July, we experienced one of the most difficult weeks that we’ve seen for a long time. As I explained in last Wednesday’s weekly portfolio update, only two sectors had gone up in the previous week … Standard Money Markets and Short Term Money Markets. Most other sectors had experienced significant losses.

At the moment it looks as though last week was a little better, but we haven’t the time to analyse the data yet … I’ll update you next week when we’ve had a chance to crunch the latest numbers.

The good news is that both portfolios have made reasonable gains since Wednesday.

The main thing that I’ve noticed over the last few months is just how volatile things have been. There are many sectors that go up one month, and down the next month, without making an overall gain.

Until this situation improves there’s very little incentive to take on any additional risk.

As always, I hope that you enjoy this month’s newsletter and I look forward to hearing any feedback.

Kind regards and best wishes,

Richard Webb

Managing Director

Comments

0 comments

Please sign in to leave a comment.