Hello Everyone,

Here is a link to the August Newsletter.

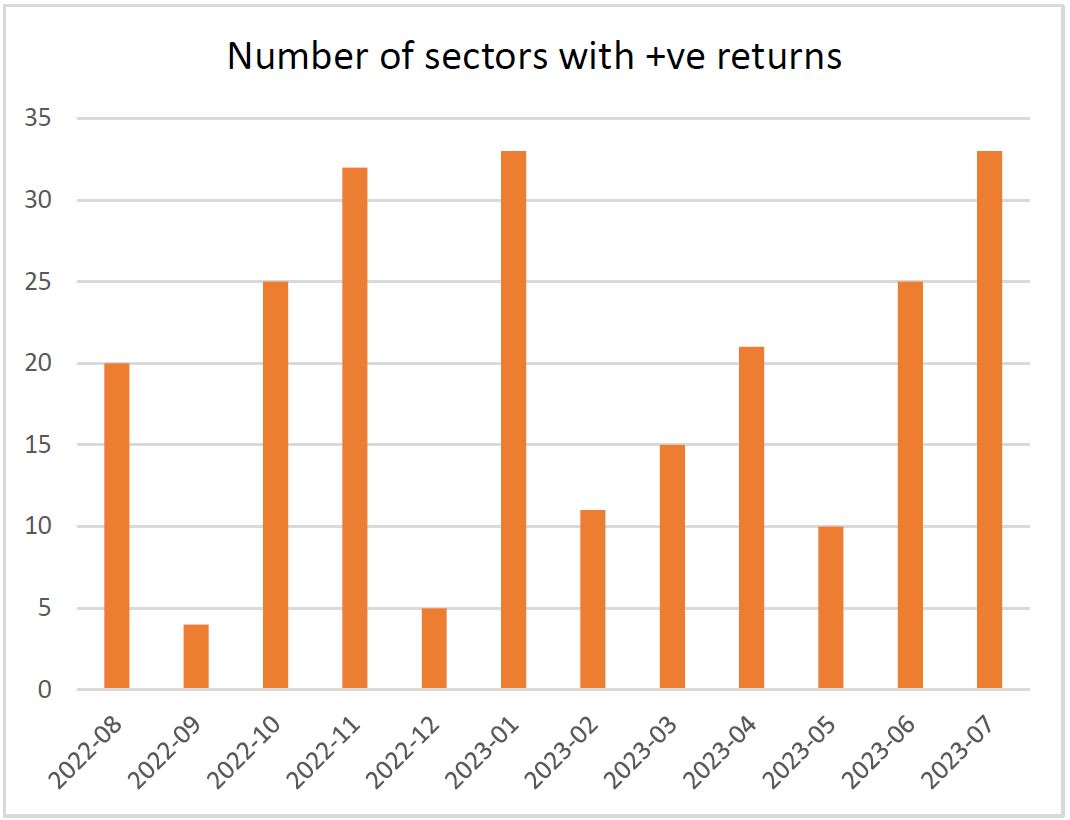

Over the last couple of months there’s been a definite improvement in the overall sector performance. 33 out of the 35 sectors that we monitor went up last month and 23 have now gone up for two consecutive months.

The problem that we’ve found recently is that as soon as we see a few good weeks in a row something comes along to spoil the party.

In the first week of July, we experienced one of the most difficult weeks that we’ve seen for a long time. As I explained in my weekly update, there was a week when only two sectors went up … Standard Money Markets and Short Term Money Markets. Most other sectors had experienced significant losses.

We then had three good weeks in a row, before the Fitch rating agency downgraded the US debt rating and put markets back into a tailspin.

So far this month, most stock markets around the world have gone down.

The FTSE 100, which briefly went above 8,000 earlier this year, is now around 7,500 … a drop of around 6%.

For the moment we’re happy keeping our powder dry. Our demonstration portfolios are still predominantly in cash, or funds from the money market sectors, and we’re fortunate that all of the other funds that we are holding have gone up since the last newsletter.

It’s not unusual to see markets pick up as we head into autumn, and we’re well positioned to take advantage if there is a rally towards the end of the year.

As always, I hope that you enjoy this month’s newsletter and I look forward to hearing any feedback.

Over the last couple of months there’s been a definite improvement in the overall sector performance. 33 out of the 35 sectors that we monitor went up last month and 23 have now gone up for two consecutive months.

The problem that we’ve found recently is that as soon as we see a few good weeks in a row something comes along to spoil the party.

In the first week of July, we experienced one of the most difficult weeks that we’ve seen for a long time. As I explained in my weekly update, there was a week when only two sectors went up … Standard Money Markets and Short Term Money Markets. Most other sectors had experienced significant losses.

We then had three good weeks in a row, before the Fitch rating agency downgraded the US debt rating and put markets back into a tailspin.

So far this month, most stock markets around the world have gone down.

The FTSE 100, which briefly went above 8,000 earlier this year, is now around 7,500 … a drop of around 6%.

For the moment we’re happy keeping our powder dry. Our demonstration portfolios are still predominantly in cash, or funds from the money market sectors, and we’re fortunate that all of the other funds that we are holding have gone up since the last newsletter.

It’s not unusual to see markets pick up as we head into autumn, and we’re well positioned to take advantage if there is a rally towards the end of the year.

As always, I hope that you enjoy this month’s newsletter and I look forward to hearing any feedback.

Kind regards and best wishes,

Richard Webb

Managing Director

Comments

0 comments

Please sign in to leave a comment.