Hello Everyone,

It is said about the successful development of man that adversity favoured the versatile. I believe it is the same with both life and investing.

I think that most of us would agree that the UK’s economy, along with most others in the world, are presently under considerable strain. This is particularly unfortunate for the poor in the developing world, and just as lamentable for the people at the bottom end of the ladder in the developed countries of the West.

But the problem is nothing new. It was Cicero in 55BC who stated the following. “The budget should be balanced, the treasury should be refilled, public debt should be reduced and unnecessary assistance to people and foreign lands should be reduced, less Rome becomes bankrupt. People must again learn to work instead of living on public assistance.”

Although I am a great believer in Democracy, as opposed to a Dictatorship, perhaps there is a time when a coming together of all political parties is the best way to temporarily address and defeat the problems of the day. This seemed to work during the Second World War. You cannot run a government with one single person. What instead matters is that the leadership gathers around itself extraordinary individuals, and then gets the best from them. Today, too many people from all sides of the political spectrum, who influence policy and future events, unfortunately also have eyebrows that meet when they try to think!

A contrary approach to the above might be to follow the example of the new chainsaw wielding President Milei of Argentina. Within days of his taking office he had reduced the number of ministries by half, and made similar reductions in department chiefs and under secretaries. All unnecessary ministerial expenditure, staff cars, travel accounts and entertainment budgets were cut. This is an extreme example of speeding up decision making, and saving money by cutting out accumulated deadwood. Just imagine how much fun he would have tackling some of our institutions!

Hopefully his approach will release a flood of people from unproductive to eventual productive employment. Only time will show whether he is able to weather the oncoming storm of vested interest which will inevitably unite to try and bring him down.

Over the last couple of years, investing has required a definite safety-first approach to avoid financial losses. At Saltydog, when we woke up to this fact, we initially moved heavily into cash and then later into the Safe Haven group (Royal London Short Term Money Markets, L&G Cash Trust, Aberdeen Sterling Money) where there were marginal gains to be made over the interest returns from cash. A couple of weeks ago it looked as if two of our old favourites (Royal London Sustainable World and Liontrust SF Managed), both in the Slow Ahead group, might be showing some signs of coming back to life. They’ve recently dropped off the radar but will need watching as a potential place for a further realignment of some of this money in the near future. We are still holding the Liontrust Balanced fund which was the top fund in the Slow Ahead group last year.

The Jupiter India fund has also performed well, up over 30% in 2023, and remains one of my firm favourites. India has a large, relatively young, hard-working population, and the country is endowed with a wealth of natural resources. It has been the fastest-growing major economy for the last two years and is on track to becoming the world’s third largest economy by the end of the decade. My only concern is that after such a good run, stock prices might be due a correction before continuing on their upward journey.

Renewable energy investments in solar panels, wind generators and hydrogen, have for sometime received huge amounts of attention and money. These were to be the saviours of our world by reducing greenhouse gases and slowing down the warming of the planet, and this is probably still the case. Unfortunately, they have proven to be more expensive to produce and maintain than anticipated, making it harder to achieve our politicians net zero target of 2050.

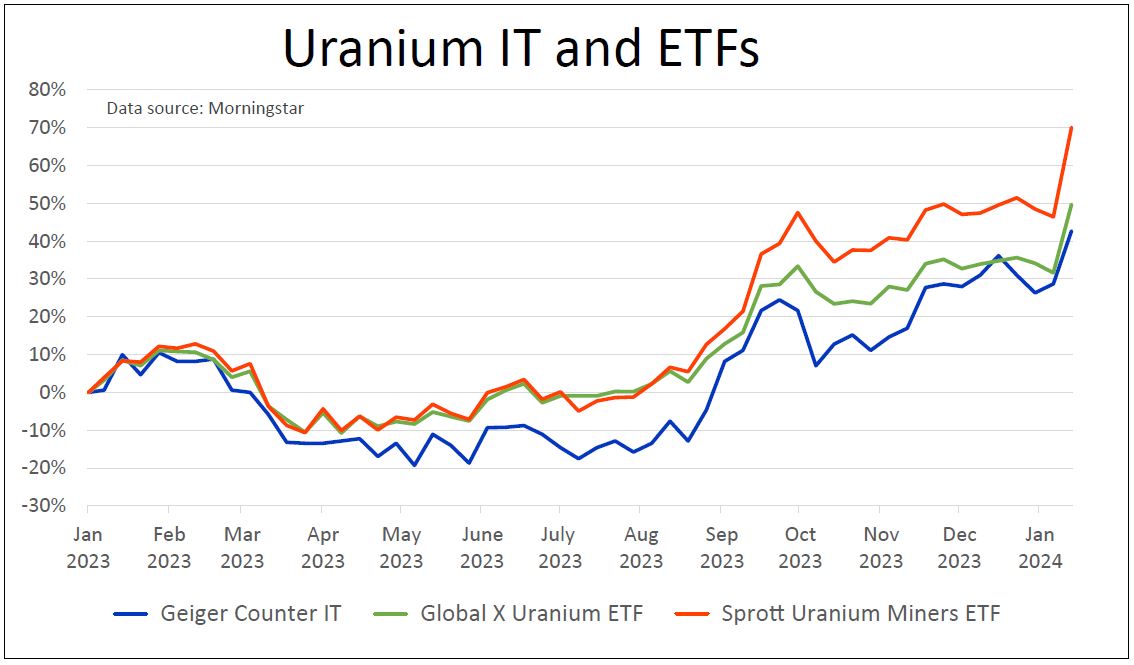

There now seems to be little dispute that nuclear energy will have to be brought on-stream to provide the total volume of energy needed to give countries security of supply, and this could be another investment opportunity. This time I must be careful not to repeat the mistakes I made in being over enthusiastic in a couple of companies in the Hydrogen arena. It hurt, and I must be more circumspect and cautious with my nuclear selections. At the moment there are only a few. There’s one Investment Trust, a couple of ETFs, and I also own shares in a company called Yellow Cake. So far so good, but this time I intend to watch more carefully.

I am not in the business of forecasting the future movements of the markets, and I will only try to report the tide is coming in when my feet get wet! Nevertheless, currently there is so much active and future potential conflict in the world, that 2024 must surely be the year to remain cautious. I for one will be keeping my powder dry by continuing to keep the bulk of my investments in the Safe and Slow sectors.

I leave you with this thought. I now have silver in my hair, gold in my teeth, crystals in my kidneys, sugar in my blood, iron in my arteries, and an inexhaustible supply of natural gas. Whoever would have thought you could accumulate such wealth!

It is said about the successful development of man that adversity favoured the versatile. I believe it is the same with both life and investing.

I think that most of us would agree that the UK’s economy, along with most others in the world, are presently under considerable strain. This is particularly unfortunate for the poor in the developing world, and just as lamentable for the people at the bottom end of the ladder in the developed countries of the West.

But the problem is nothing new. It was Cicero in 55BC who stated the following. “The budget should be balanced, the treasury should be refilled, public debt should be reduced and unnecessary assistance to people and foreign lands should be reduced, less Rome becomes bankrupt. People must again learn to work instead of living on public assistance.”

Although I am a great believer in Democracy, as opposed to a Dictatorship, perhaps there is a time when a coming together of all political parties is the best way to temporarily address and defeat the problems of the day. This seemed to work during the Second World War. You cannot run a government with one single person. What instead matters is that the leadership gathers around itself extraordinary individuals, and then gets the best from them. Today, too many people from all sides of the political spectrum, who influence policy and future events, unfortunately also have eyebrows that meet when they try to think!

A contrary approach to the above might be to follow the example of the new chainsaw wielding President Milei of Argentina. Within days of his taking office he had reduced the number of ministries by half, and made similar reductions in department chiefs and under secretaries. All unnecessary ministerial expenditure, staff cars, travel accounts and entertainment budgets were cut. This is an extreme example of speeding up decision making, and saving money by cutting out accumulated deadwood. Just imagine how much fun he would have tackling some of our institutions!

Hopefully his approach will release a flood of people from unproductive to eventual productive employment. Only time will show whether he is able to weather the oncoming storm of vested interest which will inevitably unite to try and bring him down.

Over the last couple of years, investing has required a definite safety-first approach to avoid financial losses. At Saltydog, when we woke up to this fact, we initially moved heavily into cash and then later into the Safe Haven group (Royal London Short Term Money Markets, L&G Cash Trust, Aberdeen Sterling Money) where there were marginal gains to be made over the interest returns from cash. A couple of weeks ago it looked as if two of our old favourites (Royal London Sustainable World and Liontrust SF Managed), both in the Slow Ahead group, might be showing some signs of coming back to life. They’ve recently dropped off the radar but will need watching as a potential place for a further realignment of some of this money in the near future. We are still holding the Liontrust Balanced fund which was the top fund in the Slow Ahead group last year.

The Jupiter India fund has also performed well, up over 30% in 2023, and remains one of my firm favourites. India has a large, relatively young, hard-working population, and the country is endowed with a wealth of natural resources. It has been the fastest-growing major economy for the last two years and is on track to becoming the world’s third largest economy by the end of the decade. My only concern is that after such a good run, stock prices might be due a correction before continuing on their upward journey.

Renewable energy investments in solar panels, wind generators and hydrogen, have for sometime received huge amounts of attention and money. These were to be the saviours of our world by reducing greenhouse gases and slowing down the warming of the planet, and this is probably still the case. Unfortunately, they have proven to be more expensive to produce and maintain than anticipated, making it harder to achieve our politicians net zero target of 2050.

There now seems to be little dispute that nuclear energy will have to be brought on-stream to provide the total volume of energy needed to give countries security of supply, and this could be another investment opportunity. This time I must be careful not to repeat the mistakes I made in being over enthusiastic in a couple of companies in the Hydrogen arena. It hurt, and I must be more circumspect and cautious with my nuclear selections. At the moment there are only a few. There’s one Investment Trust, a couple of ETFs, and I also own shares in a company called Yellow Cake. So far so good, but this time I intend to watch more carefully.

I am not in the business of forecasting the future movements of the markets, and I will only try to report the tide is coming in when my feet get wet! Nevertheless, currently there is so much active and future potential conflict in the world, that 2024 must surely be the year to remain cautious. I for one will be keeping my powder dry by continuing to keep the bulk of my investments in the Safe and Slow sectors.

I leave you with this thought. I now have silver in my hair, gold in my teeth, crystals in my kidneys, sugar in my blood, iron in my arteries, and an inexhaustible supply of natural gas. Whoever would have thought you could accumulate such wealth!

Best wishes and good luck with your investments.

Douglas

Founder & Chairman

Comments

0 comments

Please sign in to leave a comment.