Hello Everyone,

Here is a link to the June Newsletter.

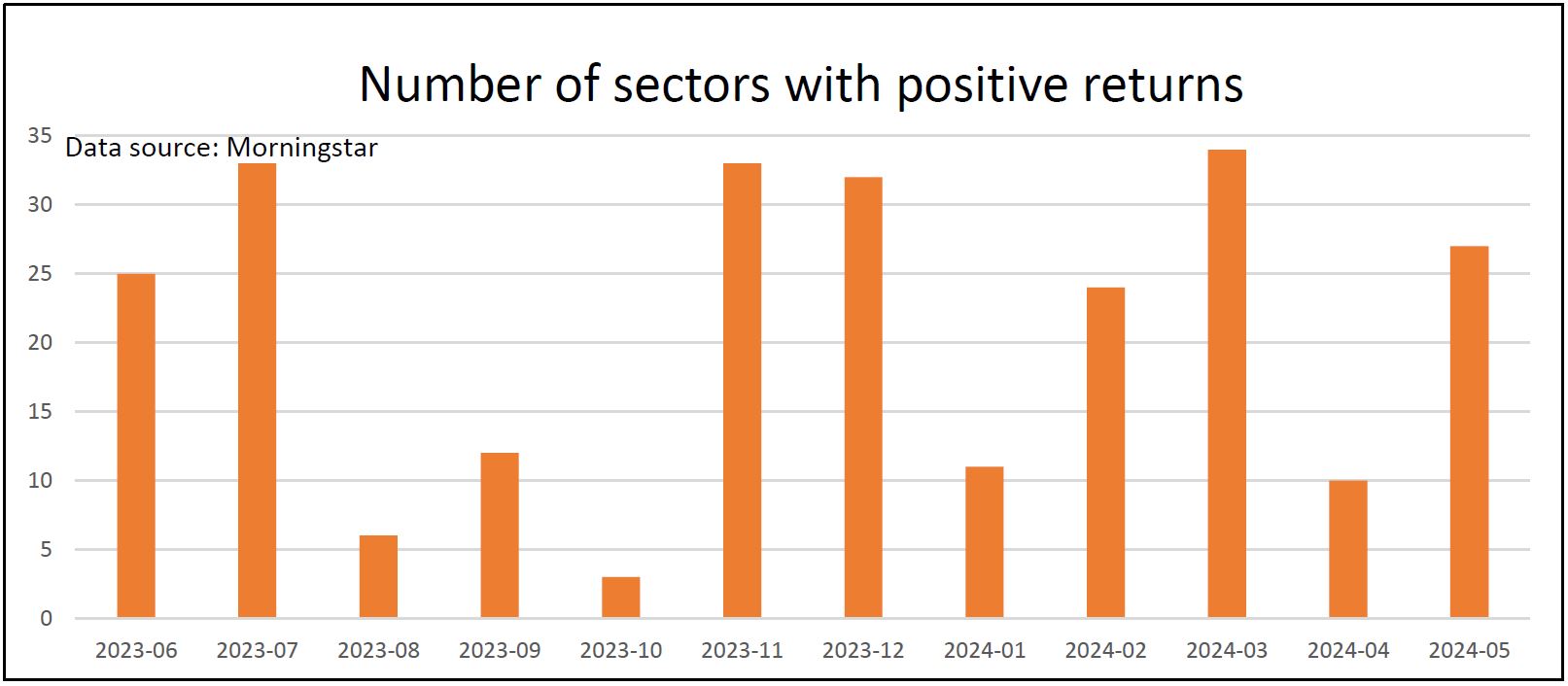

After a relatively positive couple of months, April was disappointing. Only ten out of the thirty-four sectors that we monitor went up, and some saw some significant falls. The North America sector went down by 3.1%, Japan lost 3.7%, and the North American Smaller Companies sector ended the month down 5.1%.

May was significantly better. Over the course of the month twenty-seven sectors went up, but mainly because of their performance in the first couple of weeks. Only two sectors, Short-Term Money Market and Standard Money Market, managed to make gains in each of the last two weeks of the month.

The UK equity sectors had another good month.

The best performing sector in March was UK Equity Income, up 4.4%, and it rose by a further 2.7% in April. The UK Smaller Companies sector did even better, gaining 2.9%.

Last month, the UK Smaller Companies sector led the way with a one-month return of 6.2%. The UK All Companies and UK Equity Income sectors also continued to make gains, both going up by 3.2%.

Unfortunately, in the first couple of weeks of this month, the UK equity sectors have taken a turn for the worse. UK All Companies is currently down 2.0%, UK Smaller Companies have lost 2.3%, and the UK Equity Income sector has fallen by 2.7%.

The star performer so far this month is the India/Indian Subcontinent sector, up 5.6%.

Although the portfolios briefly went down, the Tugboat portfolio is now back to where it was when we prepared the last newsletter, and the Ocean Liner has gone up by 0.3%.

When we reviewed the portfolios earlier this week, the Tugboat was showing a six-month gain of 4.5% and the Ocean Liner was up 6.4%.

Since the last newsletter, Rishi Sunak has announced that the General Election will take place on 4th July. It’s strange to think that by the time we go to write the next edtion, we may well have a new Prime Minister and a new Government.

As always, I hope that you enjoy this month’s newsletter and I look forward to hearing any feedback.

After a relatively positive couple of months, April was disappointing. Only ten out of the thirty-four sectors that we monitor went up, and some saw some significant falls. The North America sector went down by 3.1%, Japan lost 3.7%, and the North American Smaller Companies sector ended the month down 5.1%.

May was significantly better. Over the course of the month twenty-seven sectors went up, but mainly because of their performance in the first couple of weeks. Only two sectors, Short-Term Money Market and Standard Money Market, managed to make gains in each of the last two weeks of the month.

The UK equity sectors had another good month.

The best performing sector in March was UK Equity Income, up 4.4%, and it rose by a further 2.7% in April. The UK Smaller Companies sector did even better, gaining 2.9%.

Last month, the UK Smaller Companies sector led the way with a one-month return of 6.2%. The UK All Companies and UK Equity Income sectors also continued to make gains, both going up by 3.2%.

Unfortunately, in the first couple of weeks of this month, the UK equity sectors have taken a turn for the worse. UK All Companies is currently down 2.0%, UK Smaller Companies have lost 2.3%, and the UK Equity Income sector has fallen by 2.7%.

The star performer so far this month is the India/Indian Subcontinent sector, up 5.6%.

Although the portfolios briefly went down, the Tugboat portfolio is now back to where it was when we prepared the last newsletter, and the Ocean Liner has gone up by 0.3%.

When we reviewed the portfolios earlier this week, the Tugboat was showing a six-month gain of 4.5% and the Ocean Liner was up 6.4%.

Since the last newsletter, Rishi Sunak has announced that the General Election will take place on 4th July. It’s strange to think that by the time we go to write the next edtion, we may well have a new Prime Minister and a new Government.

As always, I hope that you enjoy this month’s newsletter and I look forward to hearing any feedback.

Kind regards and best wishes,

Richard Webb

Managing Director

Comments

0 comments

Please sign in to leave a comment.