Hello Everyone,

Here is a link to the August Newsletter.

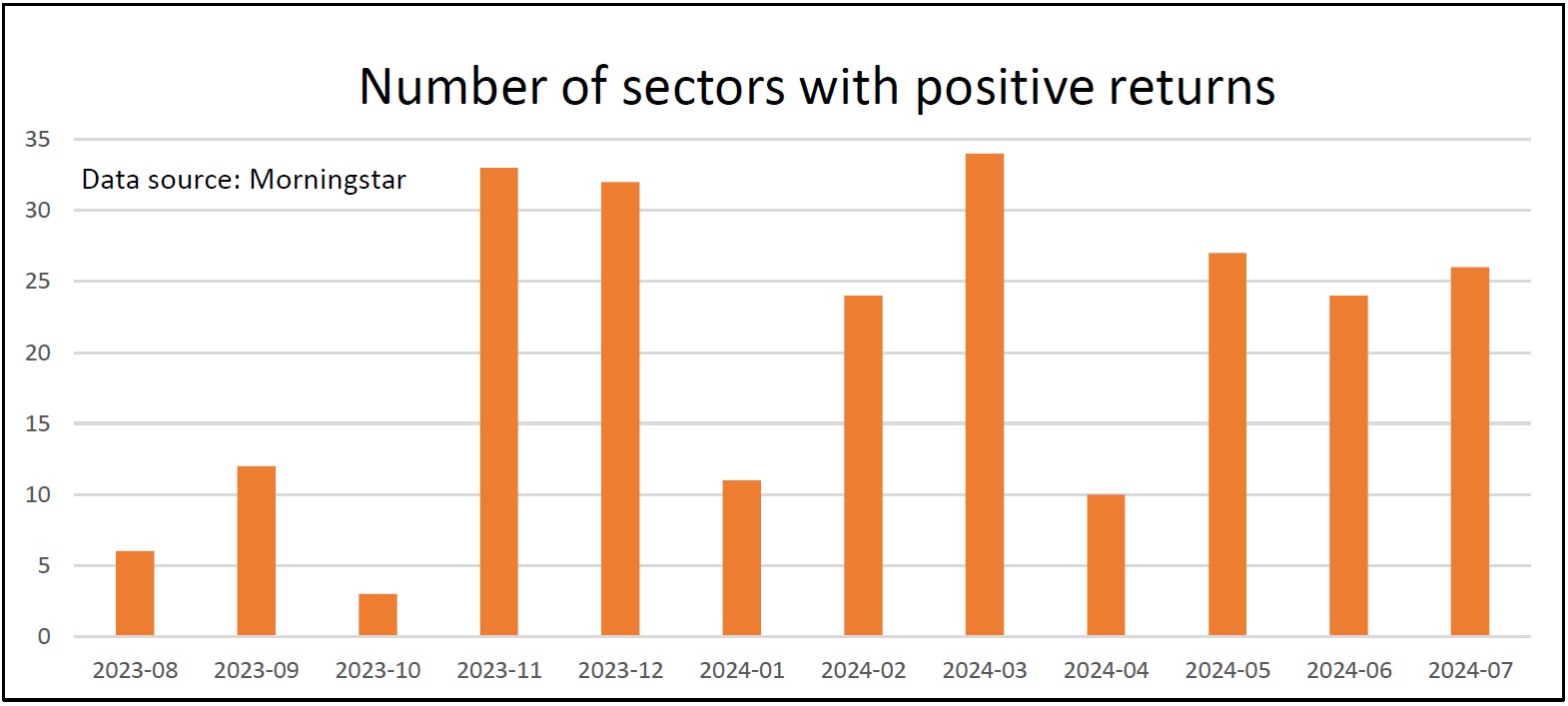

Twenty-six out of the thirty-four sectors that we monitor went up in July. An improvement on the twenty-four that went up in June, but not quite as good as the twenty-seven that went up in May.

Sixteen sectors have now made gains for three months in a row.

The best performing sector last month was North American Smaller Companies, from our ‘Full Steam Ahead Developed’ Group, with a one-month return of 5.8%.

Next was the UK Smaller Companies sector, up 4.5%, and the UK Equity Income sector wasn’t far behind, up 4.1%. The UK All Companies sector also did reasonably well, gaining 3.6%.

The Japanese, European, and Global Equity Income sectors all went up, Global was flat over the month and North America went down.

The five sectors in the Full Steam Ahead Emerging Group went down in July with the worst, Technology and Technology Innovation, losing 4.4%.

I’m sorry to say that this month hasn’t got off to a very good start.

At the end of July, the US Federal Reserve decided to hold their bank rate where it was for another month. Unfortunately, some employment and manufacturing data then came out suggesting that the economy was slowing. This sparked concerns that the central bank had kept interest rates too high for too long, and that the US might fall into a recession.

At the same time, investors were questioning the astronomical valuations associated with the 'Magnificent Seven' US technology companies. When would the massive spending on AI translate into tangible economic benefits?

The combined effect of these events caused US markets to fall, especially the Nasdaq, and there were knock-on effects all around the world.

The Bank of Japan also rather unexpectedly lifted its primary interest rate at the end of July, only its second increase in seventeen years. The Nikkei 225 fell by 2.5% the day after the announcement and then went into freefall. It dropped by 5.8% the next day and 12.4% the day after.

Since then, most stock markets have started to recover, but they are still lower than they were at the end of last month.

As always, I hope that you enjoy this month’s newsletter and I look forward to hearing any feedback.

Twenty-six out of the thirty-four sectors that we monitor went up in July. An improvement on the twenty-four that went up in June, but not quite as good as the twenty-seven that went up in May.

Sixteen sectors have now made gains for three months in a row.

The best performing sector last month was North American Smaller Companies, from our ‘Full Steam Ahead Developed’ Group, with a one-month return of 5.8%.

Next was the UK Smaller Companies sector, up 4.5%, and the UK Equity Income sector wasn’t far behind, up 4.1%. The UK All Companies sector also did reasonably well, gaining 3.6%.

The Japanese, European, and Global Equity Income sectors all went up, Global was flat over the month and North America went down.

The five sectors in the Full Steam Ahead Emerging Group went down in July with the worst, Technology and Technology Innovation, losing 4.4%.

I’m sorry to say that this month hasn’t got off to a very good start.

At the end of July, the US Federal Reserve decided to hold their bank rate where it was for another month. Unfortunately, some employment and manufacturing data then came out suggesting that the economy was slowing. This sparked concerns that the central bank had kept interest rates too high for too long, and that the US might fall into a recession.

At the same time, investors were questioning the astronomical valuations associated with the 'Magnificent Seven' US technology companies. When would the massive spending on AI translate into tangible economic benefits?

The combined effect of these events caused US markets to fall, especially the Nasdaq, and there were knock-on effects all around the world.

The Bank of Japan also rather unexpectedly lifted its primary interest rate at the end of July, only its second increase in seventeen years. The Nikkei 225 fell by 2.5% the day after the announcement and then went into freefall. It dropped by 5.8% the next day and 12.4% the day after.

Since then, most stock markets have started to recover, but they are still lower than they were at the end of last month.

As always, I hope that you enjoy this month’s newsletter and I look forward to hearing any feedback.

Kind regards and best wishes,

Richard Webb

Managing Director

Comments

0 comments

Please sign in to leave a comment.