When we started analysing all the fund and sector data in the early days of the Saltydog system, we gradually realised that some of the 33 sectors behaved in a similar fashion to other sectors. They would go up and down together - not precisely, but enough to think of them as related.

N.B. If you’d like to understand this in more detail, please see Part 2, “ From dull to unpredictable: how sectors behave”, and “Revealed: the powerful effect of volatility on your investments, in four simple charts”.

So we decided to combine the 33 sectors into just five Saltydog ‘groups’, to make it easier for us to do top-level analysis.

As I’m sure you know, different sectors of the market behave in very different ways.

Some sectors are very reliable and dependable… and a bit dull. They plod along and nothing much happens. Historically, this means things like cash – the safest, most predictable asset of all - and government bonds from well -established economies. Generally speaking (although not always, especially after the effect of QE on bond markets), your money is safe here, but it’s never going to grow very much.

Then at the other end of the scale are sectors of the market which are very unpredictable. When they go up, they really shoot up. And when they go down, they really drop down. Here we find things like small companies, emerging markets, tech and telecomms, and China. You might make a lot of money in these areas, but you might lose a lot too.

To use a more technical term, we can say that the more predictable, reliable investments have low volatility. They don’t move up and down very much.

And the more unpredictable, ‘excitable’ sectors have high volatility. They move up and down a lot.

The five Saltydog groups represent different levels of volatility, from the lowest to the highest. And in the spirit of Douglas’s early work in the merchant navy, we gave them nautical names that reflect the degree of risk involved.

Here are the five Saltydog groups - from the least to the most volatile - along with examples of the sectors included within them:

5. Full Steam Ahead (Emerging Markets) – China, Asia/Pacific, Global emerging markets

4. Full Steam Ahead (Developed Markets) – UK All companies, UK small companies, America, Japan

3. Steady As She Goes – UK equity income, Equity & bond income, flexible investment, Global.

2. Slow Ahead – UK gilts, UK corporate bonds, Absolute Return funds, Global bonds

1. Safe Haven – Money Markets

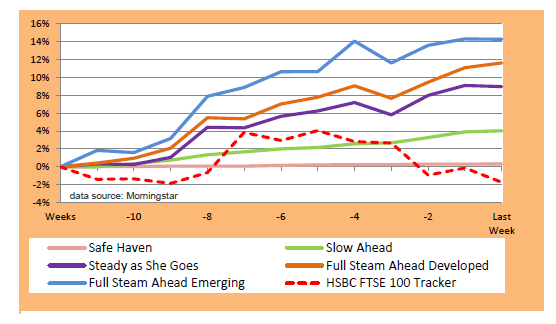

To give you a taste of how we use these groups in practice, have a look at the chart below. It’s the first chart that we give you with each weekly update of the Saltydog data.

It tracks the performance of each Saltydog group over the previous 12 weeks, and allows you to instantly compare them.

Saltydog Group Comparison

As you can see, the least volatile group – Safe Haven (pink line) – is at the bottom, with the smoothest profile and the lowest return. (Practically zero).

And the most volatile group – Full Steam Ahead, Emerging (blue line) – is at the top, with the choppiest profile and the highest return.

In other words, this particular chart (from 8th December 2015) shows the five Saltydog groups in “perfect order” – with the lowest volatility group showing the smallest return, and the highest volatility group showing the biggest return.

Of course the relative behaviour of the groups doesn’t always look like this. It depends entirely upon the overall market conditions and investor sentiment.

In very uncertain times – e.g. war, financial crisis, political turmoil - the more volatile groups can be at the bottom, with the least volatile groups outperforming them, as investors pull their money from riskier assets and put them in safer places.

The “Safe Haven” group: how do we use it?

Most of the time we will be invested in four groups: Slow Ahead, Steady As She Goes, and the two Full Steam Ahead groups (Developed & Emerging).

What about the Safe Haven group - what’s that for? Essentially the Safe Haven group is like having your money in cash. These sectors are near-cash equivalents. They are the least volatile sectors by far, but also give the lowest returns – especially during a time of very low interest rates. Essentially, moving to Safe Haven is getting out of the stock market completely.

So we would only move our money into the Safe Haven group if all the other groups were showing a negative performance. Safe Haven is exactly what it sounds like: a retreat from the market, and into cash (or near-cash).

This situation only arises in the most extreme circumstances – so most of the time we don’t include Safe Haven in the weekly analysis of our demo portfolios.

Read next > Why moving your money between sectors makes perfect sense

Comments

0 comments

Please sign in to leave a comment.