Now I am not entirely sure that I agree with this statement by Alexandre Dumas. Basically, yes I do, but in the investment world there is an awful lot of work that can be carried out which might influence the results of the “hope”, whatever that may be, whilst time passes by and you wait for the result.

It is a little like making the decision as to whether to invest your money with a financial company that makes a long-term passive investment decision with your pension, then sits and waits to see whether over time they were correct. If they were right, you win, and if they were wrong you lose.

The Saltydog momentum approach is quite different. The initial investment is still made, but then as time passes research is done and investments are changed to influence a more positive result for the “hope”.

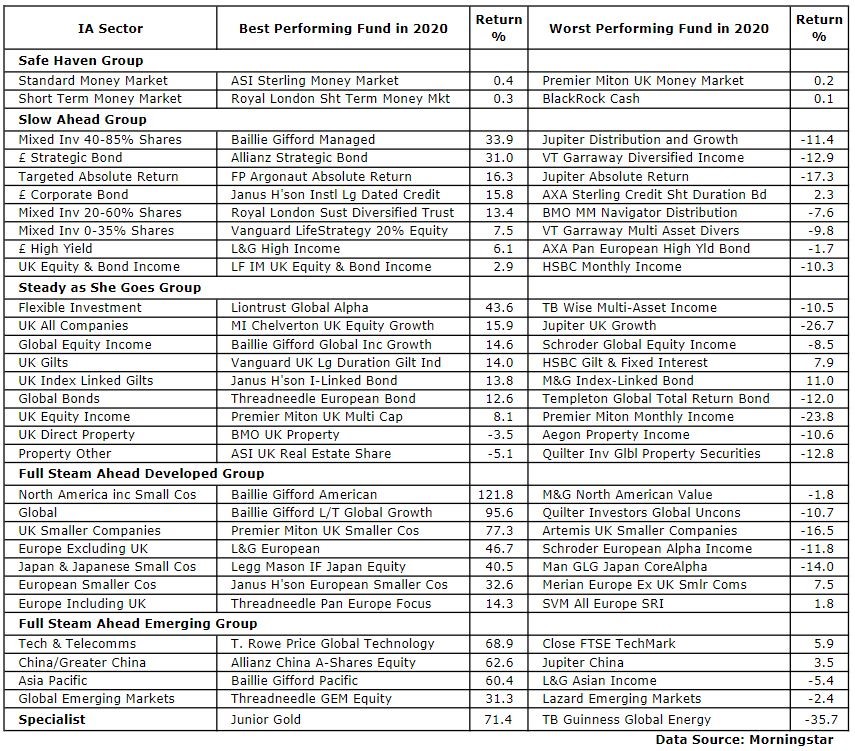

Richard has recently produced this table which highlights the best and worst performing funds in each of the IA sectors over the last year (2020). The difference between the best and worst funds is quite startling.

Most of the worst are in negative territory, whilst the best have produced handsome returns.

The most extreme example is in the North American sector where the Baillie Gifford American fund went up by 121.8%, but over the same period the M&G North American Value fund lost 1.8%.

What I find incredible, are the vast sums of money (billions and billions) that must sit unquestioned in these loser funds whilst the managers still draw down their bonuses and salaries. The whole system is just bonkers. I am pleased to say that I do not recognise the funds in the loser list, but do recognise many of the winners. To me that is strong evidence that the Saltydog system is an aid to successful investing.

When discussing this table with Richard he raised a very good point. Why do we hold so much cash when you look at the percentages in the top and bottom funds in the UK Gilts sector. The highest is 14.0% and the lowest is 7.9%. There is nothing wrong with the 7.9% when compared with 0% from the bank. If you graph the two funds you can see that they had their ups and downs, but were always positive. So I am going to experiment with my own portfolio cash holdings to see what happens if I use these gilts for a small percentage of this cash, and whether no gain can be turned into a small gain. Could be interesting!

Another sector number worth investigation is the Specialist worst performing fund TB Guinness Global Energy. It managed to lose 35.7% in 2020, and is a fund that our Ocean Liner portfolio has recently invested in. One possible reason why this fund could rebound is that after Covid has run its course, and when the economies of the world start to recover, then there should be a huge demand for energy of all types, both renewables and oil based. Electric cars are not going to magically take over from oil based driven vehicles overnight. Depressed oil prices will in theory rise quite dramatically, and energy funds should follow suit. We have three funds in our gunsights at the moment;

• TB Guinness Global Energy.

• Ninety One Global Energy.

• MSCI Global Energy Index.

I intend to take small steps into this arena in much the way that eighteen months ago we approached green/clean/ sustainable funds and the hydrogen shares. So it is a simple question of “watch this space”.

Douglas.

Comments

0 comments

Please sign in to leave a comment.