Hello Everyone,

Here is a link to the September Newsletter.

There is an old stock market saying: “Sell in May and go away, don’t come back till St Leger Day.” The idea is that summer is quiet and markets tend to drift.

Not this year.

After a sharp sell-off in April, global markets staged one of the strongest summer rallies in recent memory. The FTSE 100 broke through 9,000 for the first time, the FTSE 250 reached a three-year high, and US indices repeatedly set new records. Germany’s DAX, Japan’s Nikkei 225, and markets across Asia and South America also made strong progress.

However, August was not as buoyant as the previous months. Only eight of the twelve indices we track made gains. That was down from ten in June and July, and from the clean sweep we saw in May.

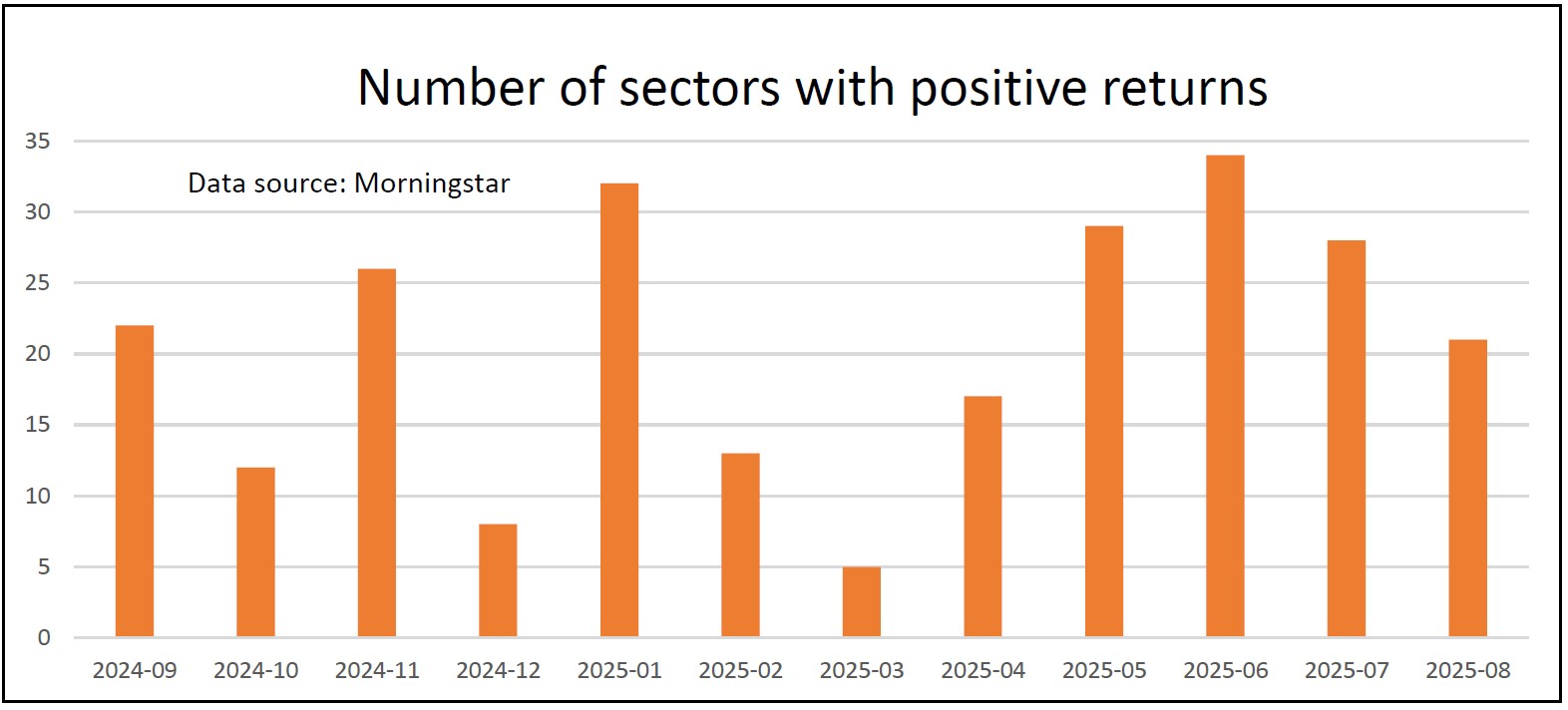

The number of sectors making gains has also gone down over the last couple of months.

June was the best month we have seen for over a year, with all 34 sectors posting positive returns. In July the number dropped to 28, and last month it was 21. Still a reasonable result, but unfortunately starting to trend downwards.

Both portfolios have gone up since the last newsletter. The Tugboat has risen by 0.7%, while the Ocean Liner has made a gain of 1.0%.

As always, I hope you enjoy this month’s newsletter, and I look forward to hearing any feedback.

There is an old stock market saying: “Sell in May and go away, don’t come back till St Leger Day.” The idea is that summer is quiet and markets tend to drift.

Not this year.

After a sharp sell-off in April, global markets staged one of the strongest summer rallies in recent memory. The FTSE 100 broke through 9,000 for the first time, the FTSE 250 reached a three-year high, and US indices repeatedly set new records. Germany’s DAX, Japan’s Nikkei 225, and markets across Asia and South America also made strong progress.

However, August was not as buoyant as the previous months. Only eight of the twelve indices we track made gains. That was down from ten in June and July, and from the clean sweep we saw in May.

The number of sectors making gains has also gone down over the last couple of months.

June was the best month we have seen for over a year, with all 34 sectors posting positive returns. In July the number dropped to 28, and last month it was 21. Still a reasonable result, but unfortunately starting to trend downwards.

Both portfolios have gone up since the last newsletter. The Tugboat has risen by 0.7%, while the Ocean Liner has made a gain of 1.0%.

As always, I hope you enjoy this month’s newsletter, and I look forward to hearing any feedback.

Kind regards and best wishes,

Richard Webb

Managing Director

Comments

0 comments

Please sign in to leave a comment.