Hello Everyone,

Exercise caution in your business affairs for the world is full of trickery. (Desiderata)

The above is completed with “But let this not blind you to what virtue there is; many persons strive for high ideals, and everywhere life is full of heroism”.

This particular section would seem to me to be particularly relevant to today's situation especially with the continuation of the Ukrainian war, struggling Western economies and political turmoil. Yet amongst all of this, there are people who stand out, looking to do their best to improve the situation for others. Admittedly, you have to look hard to find many fulfilling this role in politics, but what a dreadful occupation that is, they cannot do right for doing wrong. As Martin Lewis said recently, he would rather have his nipples connected to electrodes than become a politician!

The last few months have seen the worst performance by the Saltydog portfolios since we started up some twelve years ago. Previous major falls have still left some sectors safe and stable, but not so this time. It really has been a run for the hills event. Thank goodness we moved a large percentage into cash and can now watch and wait to see when stock markets and investment sectors show positive and definite movement in an upwards direction before reinvesting again. The American market, technology stocks, and concerns about inflation in particular, have caused us the most amount of grief. Even the sustainable funds have been dragged down with everything else.

My love affair with energy funds and hydrogen companies has cost me dearly. The energy funds not so much, but oh dear ITM and Ceres. It could be likened to being given a doughnut with the jam removed. Very disappointing! Worse still, I cannot see what has changed to cause this precipitous price slide. Why have their prospects for a golden future fallen away? It would seem that more and more money is being poured by governments and the big oil companies into hydrogen production and fuel cell technology, yet their market prices have tumbled. In ITM’s case it could be due to the C.E.O. leaving, having been in the position for fourteen years. I have taken the large hit now, so I will cling on to my holdings and hope that they recover in the not too distant future.

In days of old, when men were bold and “woke” had not been invented, it was said that to make a buck required good luck, strong boots and incentive. Back in those times I was heavily involved in selling our furniture products into Europe and America. What I used to pray for was weak sterling when I was selling in dollars, but similarly weak sterling when IKEA was purchasing from us in sterling. The latter gave us the opportunity to raise prices as they were making more margin, and the former to make gains from the exchange rate. Of course it was essential to seek material suppliers in the UK where we could to keep costs under control. They were golden days for a manufacturer prepared to do the hard work and export, and this is the currency situation that we have today at the beginning of October. I do recognise that it is a harrowing time for people converting imported material to sell in the home market, and I am not advocating weak sterling as being good for the country, because for many reasons it is not. I am just saying that it is not all bad.

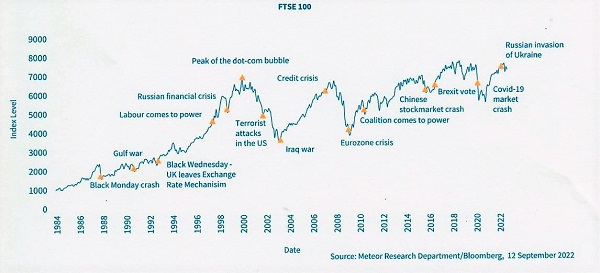

At times like this, where the markets are tumbling and bad news continues on a daily basis to exasperate the situation, I have found it useful to look at the historic movements of the FTSE 100. I hope that you find the graph below informative and interesting. The number of ups and downs, with shorter downs and longer ups, I found to be encouraging. It demonstrates that over time the trend is positive. I was also surprised by the sheer number of events causing the disturbances and the reasons for these events. In my mind it also bounced out of court those parts of the finance industry that constantly advocate staying invested and not moving into cash. To me, looking at this graph, it just makes no sense for the private investor to follow that advice.

Exercise caution in your business affairs for the world is full of trickery. (Desiderata)

The above is completed with “But let this not blind you to what virtue there is; many persons strive for high ideals, and everywhere life is full of heroism”.

This particular section would seem to me to be particularly relevant to today's situation especially with the continuation of the Ukrainian war, struggling Western economies and political turmoil. Yet amongst all of this, there are people who stand out, looking to do their best to improve the situation for others. Admittedly, you have to look hard to find many fulfilling this role in politics, but what a dreadful occupation that is, they cannot do right for doing wrong. As Martin Lewis said recently, he would rather have his nipples connected to electrodes than become a politician!

The last few months have seen the worst performance by the Saltydog portfolios since we started up some twelve years ago. Previous major falls have still left some sectors safe and stable, but not so this time. It really has been a run for the hills event. Thank goodness we moved a large percentage into cash and can now watch and wait to see when stock markets and investment sectors show positive and definite movement in an upwards direction before reinvesting again. The American market, technology stocks, and concerns about inflation in particular, have caused us the most amount of grief. Even the sustainable funds have been dragged down with everything else.

My love affair with energy funds and hydrogen companies has cost me dearly. The energy funds not so much, but oh dear ITM and Ceres. It could be likened to being given a doughnut with the jam removed. Very disappointing! Worse still, I cannot see what has changed to cause this precipitous price slide. Why have their prospects for a golden future fallen away? It would seem that more and more money is being poured by governments and the big oil companies into hydrogen production and fuel cell technology, yet their market prices have tumbled. In ITM’s case it could be due to the C.E.O. leaving, having been in the position for fourteen years. I have taken the large hit now, so I will cling on to my holdings and hope that they recover in the not too distant future.

In days of old, when men were bold and “woke” had not been invented, it was said that to make a buck required good luck, strong boots and incentive. Back in those times I was heavily involved in selling our furniture products into Europe and America. What I used to pray for was weak sterling when I was selling in dollars, but similarly weak sterling when IKEA was purchasing from us in sterling. The latter gave us the opportunity to raise prices as they were making more margin, and the former to make gains from the exchange rate. Of course it was essential to seek material suppliers in the UK where we could to keep costs under control. They were golden days for a manufacturer prepared to do the hard work and export, and this is the currency situation that we have today at the beginning of October. I do recognise that it is a harrowing time for people converting imported material to sell in the home market, and I am not advocating weak sterling as being good for the country, because for many reasons it is not. I am just saying that it is not all bad.

At times like this, where the markets are tumbling and bad news continues on a daily basis to exasperate the situation, I have found it useful to look at the historic movements of the FTSE 100. I hope that you find the graph below informative and interesting. The number of ups and downs, with shorter downs and longer ups, I found to be encouraging. It demonstrates that over time the trend is positive. I was also surprised by the sheer number of events causing the disturbances and the reasons for these events. In my mind it also bounced out of court those parts of the finance industry that constantly advocate staying invested and not moving into cash. To me, looking at this graph, it just makes no sense for the private investor to follow that advice.

Best wishes and good luck with your investments.

Douglas

Founder & Chairman

Comments

0 comments

Please sign in to leave a comment.